Business Activity Expectations Decline for 2025

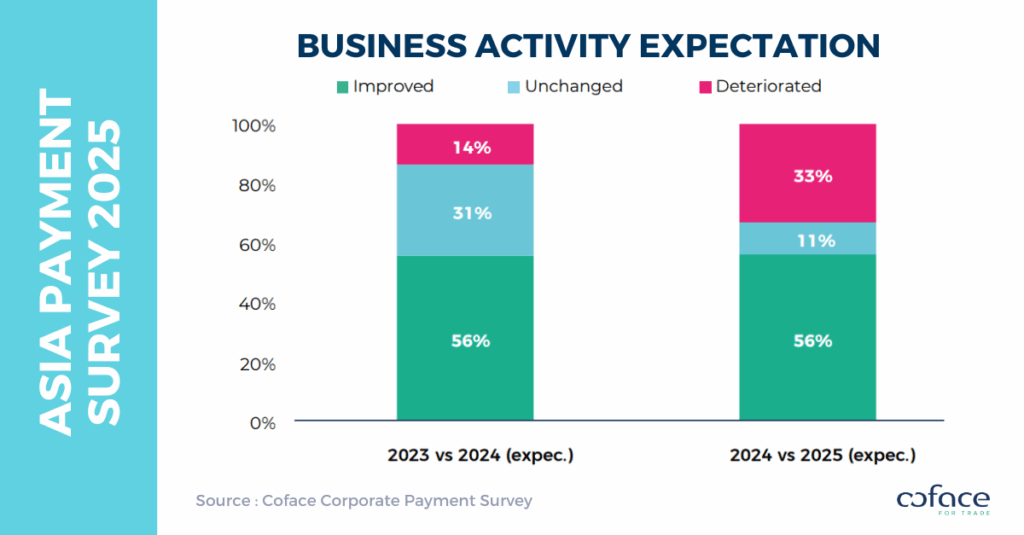

According to the 2025 Asia Payment Survey by Coface, while 56% of respondents still expect improved business activity for 2024 vs. 2025, optimism remains unchanged from the previous year. However, pessimism has increased sharply — 33% foresee deterioration, more than doubling from 14% in the previous year’s expectations. Meanwhile, those expecting no change dropped significantly from 31% to 11%.

Key Findings at a Glance

- Average payment terms inched up to 65 days in 2024 (from 64 days in 2023), yet remain below the pre-2023 five-year average of 69 days.

- Payment delays remained unchanged at 65 days, but the percentage of companies experiencing delays fell to 49%.

- The most alarming trend: a record 40% of companies reported ultra-long payment delays (ULPDs) exceeding 2% of annual turnover, up sharply from 23% in 2023. The Wood, Agro-food, and Automotive sectors saw the biggest spikes.

- 57% of businesses expect payment behaviour to deteriorate further in the next six months, citing slowing demand, rising costs, and competitive pressure as top risks.

“Asia-Pacific experienced a slowdown in growth in 2024 due to slow global demand, rising costs, and a high interest rate environment. The record surge in ULPDs signals mounting financial strain. We have revised our GDP growth forecast for Asia to 3.8% in 2025,” said Bernard Aw, Chief Economist for Asia-Pacific at Coface.

Sector Highlights: Automotive, Textiles, and Chemicals Grant Longer Credit

In 2024, credit conditions remained tight, but payment terms lengthened in 10 of 13 sectors. The automotive sector led the trend, followed by textiles and chemicals — a response to increased competition, prompting more flexible credit strategies.

Despite these shifts, two-thirds of surveyed companies expect payment terms to shorten in 2025, indicating a shift toward cash preservation amid growing economic uncertainty.

ULPDs Signal Rising Credit Risk Across the Region

ULPDs — defined as payment delays exceeding 180 days and more than 2% of annual revenue — are considered a high-risk red flag. According to Coface, 80% of such debts are never recovered.

- The highest ULPD risks were reported in China, India, Thailand, and Malaysia.

- All 13 sectors recorded increases, led by Wood (+37%), Agro-food (+20%), and Automotive (+18%).

- Transport and Automotive also saw higher average payment delays, rising by 2% and 1% respectively compared to 2023.

With 57% of companies expecting further deterioration in late payments, the financial stress on B2B transactions is set to intensify.

Outlook for 2025: Greater Risk, Lower Confidence

The region’s economic sentiment is softening. 33% of surveyed companies foresee worsening business conditions in 2025 — more than double the share from last year’s survey.

Markets like Taiwan and Singapore appear most pessimistic, with over 40% of companies in both economies anticipating a downturn.