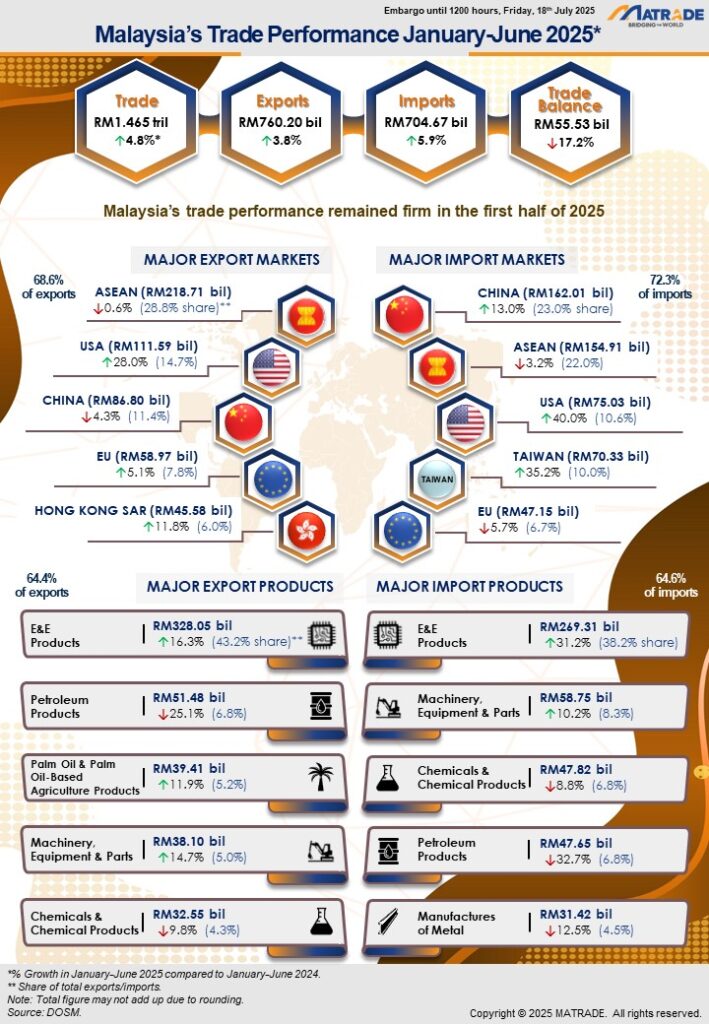

Malaysia’s trade performance for the first half of 2025 has reached a record-breaking RM1.465 trillion, growing 4.8% year-on-year (y-o-y) compared to the same period in 2024. This impressive figure reflects the highest cumulative trade value ever recorded for January to June, despite a slight 1.2% y-o-y contraction in trade recorded for June 2025.

Exports for the first half rose by 3.8% to RM760.2 billion, while imports increased by 5.9% to RM704.67 billion, yielding a trade surplus of RM55.53 billion. June itself registered RM234.85 billion in trade value, with exports contributing RM121.72 billion and imports at RM113.13 billion.

This marks the 62nd consecutive month of trade surplus since May 2020 – a testament to the resilience and competitiveness of Malaysian exports amid global headwinds.

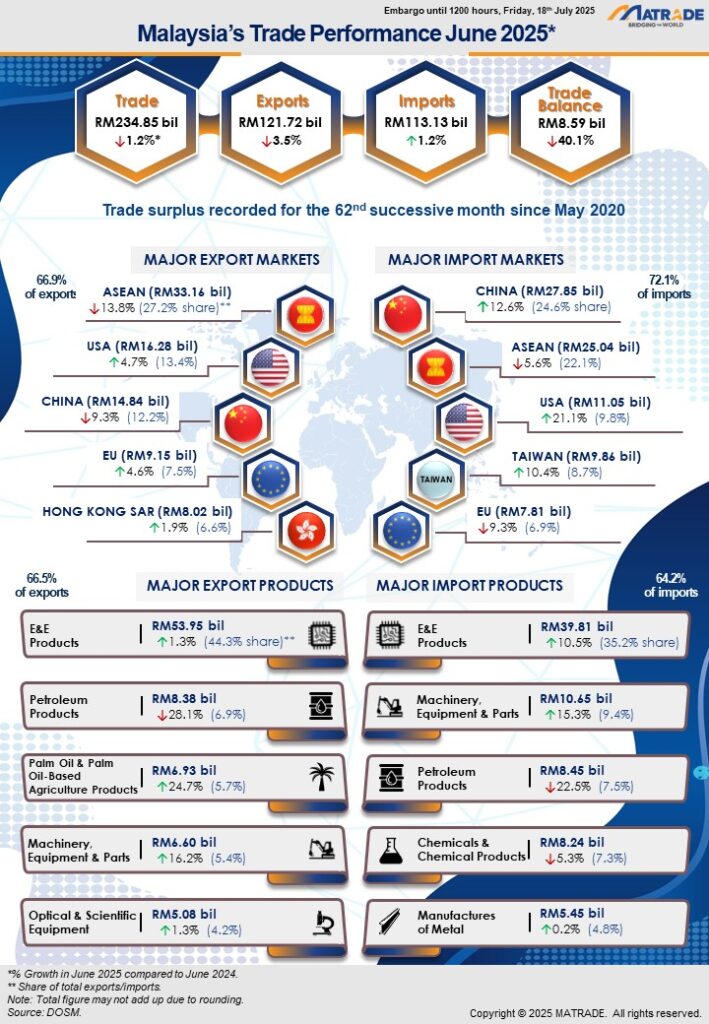

June 2025 Overview: Trade Marginally Contracts but Remains Strong

June’s total trade dipped by RM2.93 billion, or 1.2%, y-o-y, primarily due to lower export volumes in petroleum and mining products. Exports contracted by 2.4%, while imports saw a modest 1.2% increase.

Exports of palm oil and palm oil-based agriculture products jumped 24.7% year-on-year in June, continuing a 15-month growth streak thanks to stronger global demand and higher prices.

Meanwhile, electrical and electronics (E&E) products – which made up 44.3% of total exports – grew 1.3%, aligning with the World Semiconductor Trade Statistics’ projected global growth of 11.2% for the sector.

Other strong-performing export categories included:

- Machinery, equipment and parts (+16.2%)

- Processed food (+8.7%)

- Optical and scientific equipment (+1.3%)

In contrast, exports of petroleum products and LNG declined sharply, weighing down total manufacturing and mining export numbers.

On a month-on-month basis, however, exports surged 8.4% (an increase of RM9.39 billion), suggesting a potential rebound heading into Q3.

1H 2025 Highlights: Surging Demand in Strategic Sectors

Malaysia’s manufacturing sector, which constituted 85.4% of total exports in 1H 2025, expanded 3.7% y-o-y to RM649.02 billion.

Key contributors included:

- Electrical and Electronics (E&E): RM336.52 billion (+3.9%), accounting for 44.3% of total exports

- Petroleum products: RM59.63 billion (+3.8%)

- Machinery, equipment and parts: RM32.81 billion (+16.5%)

- Optical and scientific equipment: RM24.26 billion (+5.4%)

- Processed food: RM13.16 billion (+10.5%)

Meanwhile, agriculture exports jumped 13.8% y-o-y, with palm oil and palm oil-based products growing 13.3% to RM29.14 billion, thanks to robust demand and favourable pricing.

Mining and Commodities: Mixed Signals

The mining sector saw a minor contraction of 0.6% to RM61.43 billion, largely due to declining global demand for LNG. However, crude petroleum exports rose 2.1% due to higher export volume and prices.

Imports: Capital Goods Point to Business Optimism

Total imports in 1H 2025 hit RM704.67 billion, an increase of RM39.14 billion (5.9%) compared to the previous year.

Growth in import categories signals strong domestic investment and consumer resilience:

- Capital goods: RM86.34 billion (+39.8%)

- Consumption goods: RM55.89 billion (+1.3%)

- Intermediate goods: RM373.88 billion (-1.9%)

The rise in capital goods – led by higher imports of parts for machinery, engines, and electrical apparatus – suggests confidence in business expansion and digitalisation efforts.

Top Export Destinations: ASEAN, US, EU Lead Recovery

Among Malaysia’s largest export destinations:

- ASEAN remained the top regional market with RM207.52 billion in exports, up 3.2%

- China absorbed RM98.59 billion in goods, a marginal 0.4% rise

- United States: RM85.09 billion (+3.8%)

- European Union: RM52.36 billion (+3.6%), with top markets including the Netherlands, Germany, and Italy

Notable growth markets in 1H 2025:

- India: RM25.81 billion (+12.6%)

- Taiwan: RM27.51 billion (+14.7%)

- Mexico: RM7.32 billion (+22.6%)

Trade with FTA Partners: Leveraging Global Access

Exports to Free Trade Agreement (FTA) partners rose 2.9% to RM501.18 billion, led by higher shipments to Hong Kong SAR, Turkey, and Chile. The expansion shows Malaysian businesses are successfully leveraging FTAs for wider market access.

Trade Outlook: Resilient Fundamentals Amid Global Uncertainty

Despite ongoing global trade volatility, Malaysia’s trade fundamentals remain robust – underpinned by diversified markets, thriving electronics exports, and government initiatives to strengthen ESG compliance, supply chain resilience, and digital adoption.

The Ministry of Investment, Trade and Industry (MITI) and MATRADE continue to support Malaysian exporters through targeted outreach, advisory services, and trade facilitation tools, including the MATRADE portal: https://www.matrade.gov.my/