By Aileen Anthony

Today, Lalua is many things: academic, founder, consultant, and author. But above all, she is known as “M.O.N.E.Y 👑 Q.U.E.E.N,” a title once uttered by her brother in jest, turned personal mission to help others repair, reshape, and rebuild their relationships with money.

From London to Kuala Lumpur: A Journey of Return and Reinvention

After over a decade on and off in the UK, where she worked as a FinTech consultant and auditor, Lalua returned to Malaysia in 2021, post-COVID, armed with a completed PhD and job offers. She chose to join a private university where she initially taught before transitioning into a corporate affairs role. But even that couldn’t contain her growing conviction that she needed to do more.

“I felt teaching was no longer enough,” she said. “After 25 years in and around education, I wanted to give more. To move the needle.”

It wasn’t an easy road. A knee surgery disrupted her ability to perform in her new administrative role, and by the end of 2023, she left the education scene and returned to the UK for a breather—what she called a time to reconnect and think deeply about her next move. That move came quicker than expected.

M.O.N.E.Y 👑 Q.U.E.E.N: A Name, A Movement, A Mission

While M.O.N.E.Y 👑 Q.U.E.E.N may sound like a catchy brand, it is rooted in lived experience and genuine conviction. “My brother teased me once, calling me Money Queen, and I just owned it,” she said, laughing. Today, Lalua hopes to embed financial literacy in the workplace. At the heart of this is the Employee Financial Wellness Programme.

She shared, “People assume employees know how to manage their finances. But in reality, many are struggling—stressed, confused, overwhelmed. And no one in the organisation is taking responsibility.”

Through M.O.N.E.Y 👑 Q.U.E.E.N, Lalua advocates that financial support should be part of a company’s ecosystem—designed with as much intention as business strategy. Not a tick-the-box seminar or a flashy app, but a meaningful programme embedded in the employer-employee relationship.

It Starts With You: The Core of Her Philosophy

The first chapter of Lalua’s philosophy is simple:know yourself. Before budgeting, investing, or wealth-building, individuals must confront and understand their relationship with money.

“Your relationship with money is like any other relationship,” she said. “Some love it, some hate it, some avoid it. But you need to make peace with it.”

And what does that look like?“Being able to sleep at night,” she said simply. “If you have a plan, a system, and you’re managing it, you’re at peace. That’s a good relationship with money.”

Lalua’s book, Money Moves at Work, draws on this ethos. Aimed primarily at employees, it combines practical advice with reflective tools. From understanding money personalities to structuring your budget around your emotional habits, the book builds a bridge between internal clarity and external control.

Importantly, it also points readers to real-life help, such as Malaysia’s AKPK (Agensi Kaunseling dan Pengurusan Kredit), which she credits for helping her restructure her own financial challenges. “That experience changed me,” she said. “I haven’t had a credit card since.”

Building the Ecosystem

During her time in education, Lalua launched an AKPK Club, bringing financial literacy into student life. From there, her work extended further, evolving into the “MyCelik” movement in Malaysia and Indonesia, for which she serves as Chairman. “We launched “MyCelik” in Malaysia, and then started engaging schools in Indonesia. The young are warm, responsive, and incredibly interested in financial literacy,” she said.

The mission may have spread its wings internationally, but it remains rooted in Malaysia. Lalua continues to speak at universities, consult with banks, and explore new collaborations, including integration with the Ekonomi Madani agenda.

From Book to Comic: Reaching Younger Minds

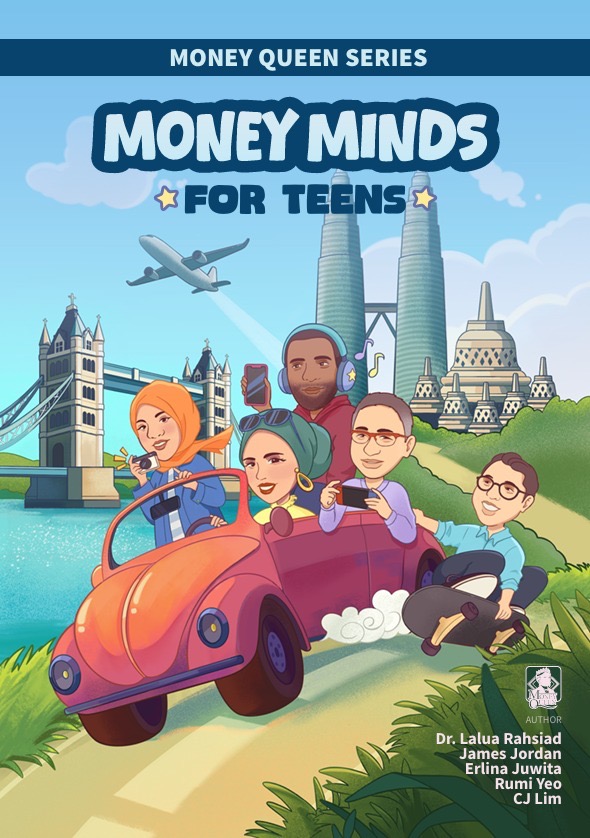

If “Money Moves at Work ” was her manifesto, her upcoming release, Money Minds for Teens, is her outreach to the next generation.

A collaborative effort involving contributors from Malaysia, the UK, and Indonesia, the book is designed as a comic to make financial literacy accessible to teenagers aged 13–17. Launching in February 2026, it features illustrated characters like “Ibu Erlina” from Jakarta and “James” from the UK alongside “Rumi” and “CJ” from Malaysia.

“I’ve done the hard part—building a programme from scratch for employees,” she said. “Now I’m scaling backwards to capture young minds before they develop toxic money habits.”

What’s Next?

For now, Lalua continues to balance multiple roles—as author, founder, advocate, and mentor—and is open to collaboration.

“I can’t do this alone,” she admitted. “This movement needs partners. It needs believers.”

And what she offers in return isn’t just financial advice—but a mindset shift, rooted in empathy, lived experience, and a real belief that financial literacy isn’t a privilege—it’s a right.