The index, a key barometer of entrepreneurial sentiment in Malaysia, combines ground-level insights from MSMEs with forward-looking indicators to provide a holistic view of the evolving business landscape and national economic direction.

The SME Sentiment Index for 1H 2025 registered a score of 55.2, signaling continued optimism despite a slight dip from 55.8 in 2H 2024. The index remains comfortably above the neutral mark of 50, indicating overall business confidence remains intact, though slightly moderated from the post-pandemic recovery highs.

“SME Bank’s SME Sentiment Index registered a solid 55.2 in the first half of 2025, reflecting continued optimism among entrepreneurs nationwide. While this marks a slight moderation from 55.8 in the previous half, the index remains well above the neutral level of 50, indicating steady confidence despite a softening from the strong post-COVID rebound observed in earlier surveys. Entrepreneurs are showing more cautious optimism, citing softer expectations around sales, expansion, and hiring. This sentiment echoes broader economic signs, reflecting recalibration in alignment with the MADANI Economic Framework, which prioritises sustainable, inclusive growth. While short-term sentiment has softened, Malaysia remains on a steady growth path, supported by structural reforms, high-quality investments, and a focus on resilience and shared prosperity,”

— said Datuk Dr. Mohammad Hardee Ibrahim, Acting Group President/CEO, SME Bank.

Key Highlights at a Glance:

- US reciprocal tariff influences MSMEs’ expectation on economic outlook

- Micro businesses foresee better sales performance than previously

- The cost of doing business remains high due to both domestic and international affairs

- MSMEs’ low exposure to external markets is a blessing in disguise

- Slow hiring due to easing sales expectations

- E-invoicing creates a positive impression as implementation kicks in

- Gradual increase in ESG adoption

- Expansion remains as businesses’ top priority, albeit moderating

- MSMEs are deemed to be financially sustainable, but more challenges ahead

Commenting on the broader implications of the survey, Lynette Lee Li Qing, SME Bank’s Chief Economist, said the index serves as a valuable leading indicator of the country’s near-term economic direction.

“As a leading economic indicator, this SME Sentiment Index suggests that Malaysia’s overall economy will continue to expand in 2025, albeit at a modest pace. Our 1Q 2025 GDP growth eased to 4.4% YoY (4Q 2024: 4.9%), the lowest since 1Q 2024 (4.2%) which signals a weak start to the year as it slipped off the official 2025 GDP forecast range (4.5% – 5.5%). World Bank has recently revised Malaysia’s GDP growth forecast down to 3.9%, alongside a cut in global growth due to heightened uncertainties arising from trade tension. Nonetheless, Malaysia’s growth rate is still above some regional peers such as Thailand (3.1%) and Singapore (3.9%).”

She added that the more tempered optimism recorded aligns with the Department of Statistics Malaysia (DOSM) Leading Index, which also indicates potential softening in the months ahead.

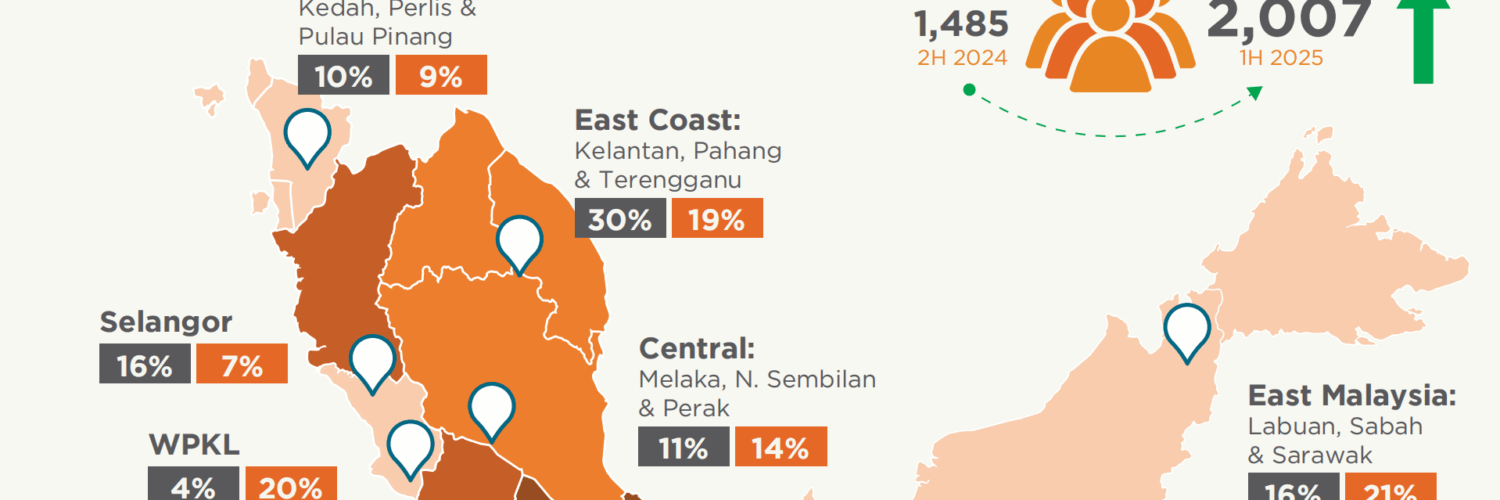

The 1H 2025 index is based on a record 2,007 respondents, significantly higher than the 1,485 surveyed in 2H 2024. It covers 39 sectors across all business sizes, offering one of the most comprehensive snapshots of MSME sentiment in the country. This dataset serves as a reference point for policymakers and business leaders to gauge trends and support measures going forward.