Malaysia recorded its highest cumulative trade values for the first eight months of 2025. Total trade rose by 3.8% year-on-year to RM1.977 trillion, with exports climbing 3.9% to RM1.032 trillion. Notably, exports surpassed the RM1 trillion mark a month earlier than in 2024. Imports also grew 3.6% to RM945.62 billion, resulting in a trade surplus of RM86.07 billion.

August 2025 Snapshot

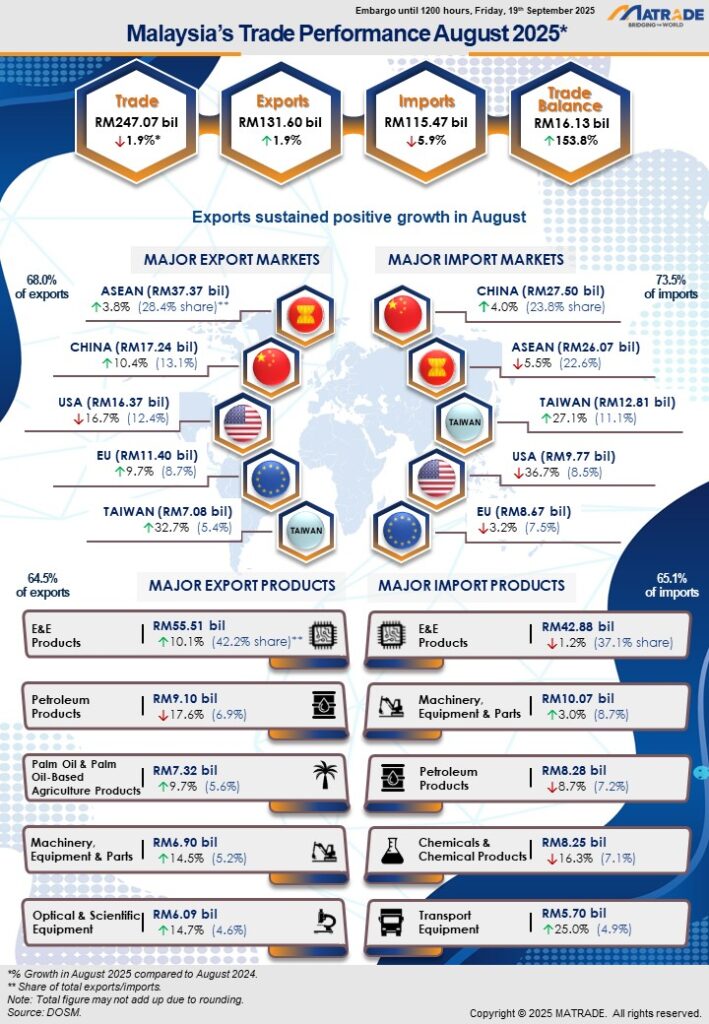

For August alone, Malaysia’s trade dipped slightly by 1.9% year-on-year to RM247.07 billion, reflecting global trade uncertainties. Despite this, exports expanded for the second straight month, up 1.9% to RM131.6 billion, while imports fell by 5.9% to RM115.47 billion. The monthly trade surplus widened to RM16.13 billion, an increase of 153.8% compared to August 2024, extending the nation’s streak of trade surpluses to 64 consecutive months.

Sector Highlights

- Electrical & electronic (E&E) products remained the backbone of exports, rising 10.1% year-on-year to RM55.51 billion.

- Machinery, equipment and parts posted a strong increase of 14.5% to RM6.9 billion.

- Optical and scientific equipment hit its highest value to date, jumping 14.7% to RM6.09 billion.

- Palm oil and palm oil-based agriculture products saw a rebound, up 9.7% to RM7.32 billion.

Exports of agriculture goods overall rose 4.5% year-on-year in August, reversing July’s contraction. Mining goods, however, declined by 2.4%, mainly due to lower crude petroleum volumes and prices.

Trade with Key Markets

- ASEAN remained Malaysia’s largest regional partner, making up 25.7% of trade. Exports rose 3.8% to RM37.37 billion, with strong growth in Thailand (+20.7%) and Viet Nam (+31.3%).

- China trade increased 6.4% year-on-year to RM44.74 billion, with exports surging 10.4%, fuelled by E&E products and palm oil-based manufactured goods.

- United States trade fell 25.5% to RM26.14 billion in August, reflecting tariff adjustments. However, January–August exports to the US still grew 17.5% year-on-year.

- European Union trade rebounded, with exports up 9.7% to RM11.4 billion, driven by E&E and palm oil.

- Taiwan recorded the sharpest rise, with exports up 32.7% in August and 30.5% in the January–August period.

Imports and Domestic Impact

Malaysia’s imports in August fell 5.9% year-on-year to RM115.47 billion. By category:

- Intermediate goods contracted 16.8% (RM60.25 billion).

- Capital goods rose 11% (RM15.72 billion), signalling industrial investment.

- Consumption goods declined 8.9% (RM9.41 billion).

From January–August 2025, imports still registered growth at 3.6%, led by stronger demand for capital goods.

Looking Ahead

Despite short-term volatility in certain markets, Malaysia’s trade performance remains resilient. Exporters are encouraged to diversify products, strengthen supply chains, and fully utilise the 18 Free Trade Agreements (FTAs) ratified by Malaysia.

With E&E products, machinery, and palm oil leading growth, Malaysia is well-positioned to sustain its competitiveness in global trade while navigating shifts in international trade policies.