By Previn Pillay

SMEs: Malaysia’s Economic Backbone

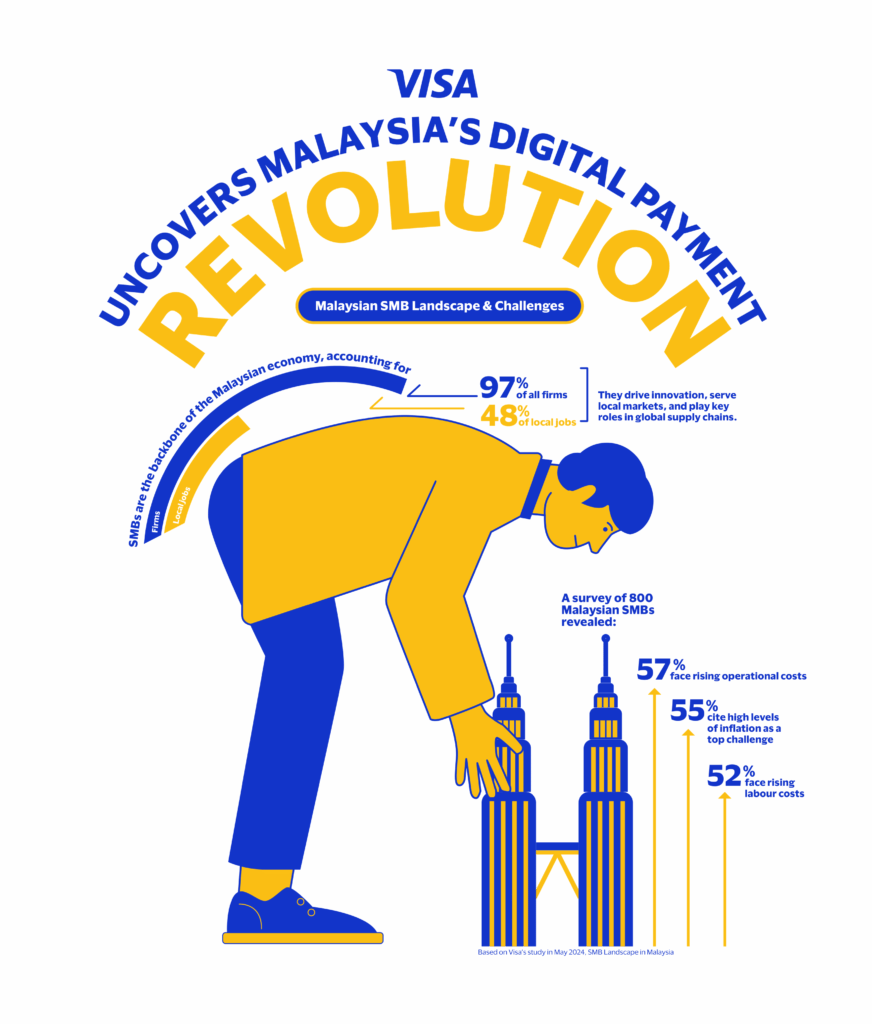

Small and medium-sized enterprises (SMEs) are the driving force of the Malaysian economy, accounting for 97% of all businesses and contributing nearly 48% of total employment.1 These enterprises are crucial in fostering local innovation, serving niche consumer demands, and anchoring Malaysia in global trade ecosystems.

Cost Pressures and Operational Struggles

Yet despite their central role, many SMEs face mounting headwinds. Visa’s Evolving SMB Landscape in Malaysia report, based on a survey of 800 SMEs, reveals that:

- 57% of SMEs struggle with rising operational costs

- 55% are affected by high inflation

- 52% are burdened by labour-related expenses

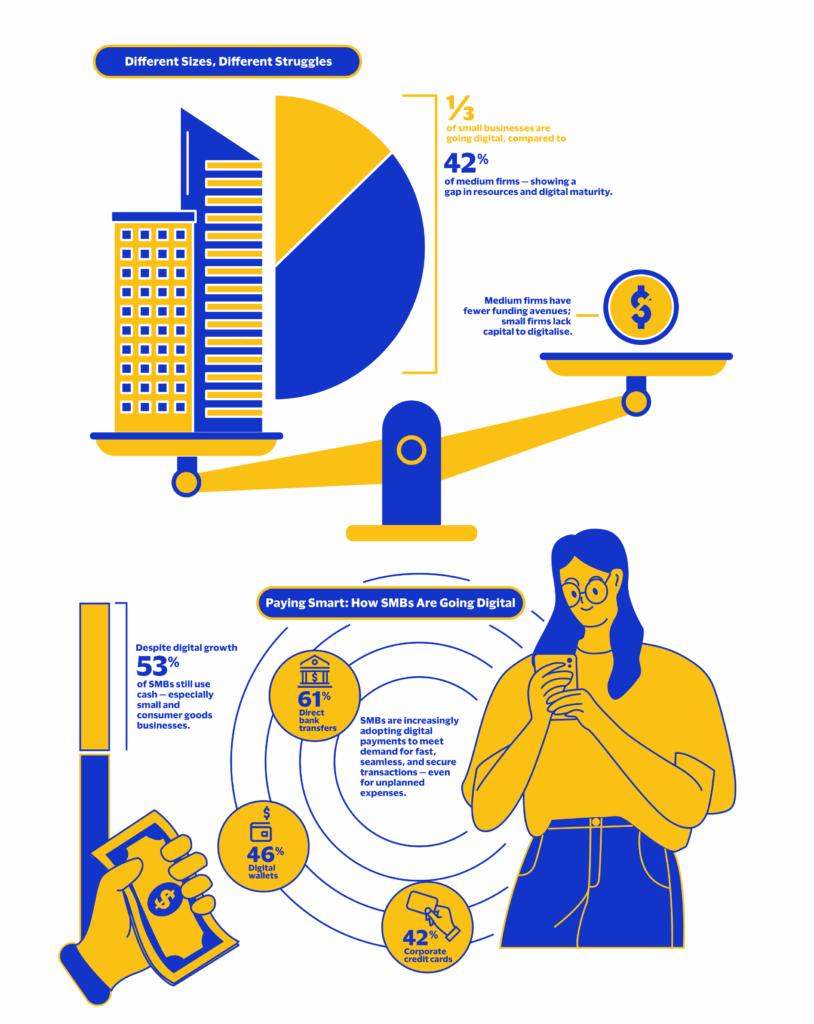

Smaller firms, with more constrained resources, often struggle to invest in growth initiatives such as digitalisation. Meanwhile, medium-sized businesses—though more mature—encounter increased scaling costs and limited access to financing.

Embracing Digital Tools to Compete

Digitalisation is becoming a cornerstone for growth and resilience. From cloud-based inventory systems to digital ordering platforms, SMEs are adopting tools that enhance efficiency, reduce manual errors, and open new market channels.

Medium-sized businesses are currently leading in digital adoption, with 42% prioritising the integration of digital tools, compared to about one-third of small firms. Looking ahead, technologies such as AI and automation are poised to help SMEs personalise customer experiences and increase productivity. An IDC report estimates that a third of Asia-Pacific SMEs will boost their investments in digital automation by 2026.2

A Digital Payments Revolution

Digital payments are rapidly transforming how SMEs transact. Malaysian SMEs are now widely adopting cashless options not only for consumer transactions but also to manage supply chain payments. According to Visa’s study:

- Online payments are the top choice

- 61% of SMEs use direct bank transfers

- 46% use digital wallets, particularly among smaller businesses

These payment methods are especially relevant to Malaysia’s large population of street vendors, many of whom operate in an environment where bank accounts, credit and traditional banking services are scarce.3 The move towards digital payments helps SMEs reduce transaction costs, speed up cash flow, and better meet evolving consumer expectations.

Empowering Street Vendors and Micro-SMEs

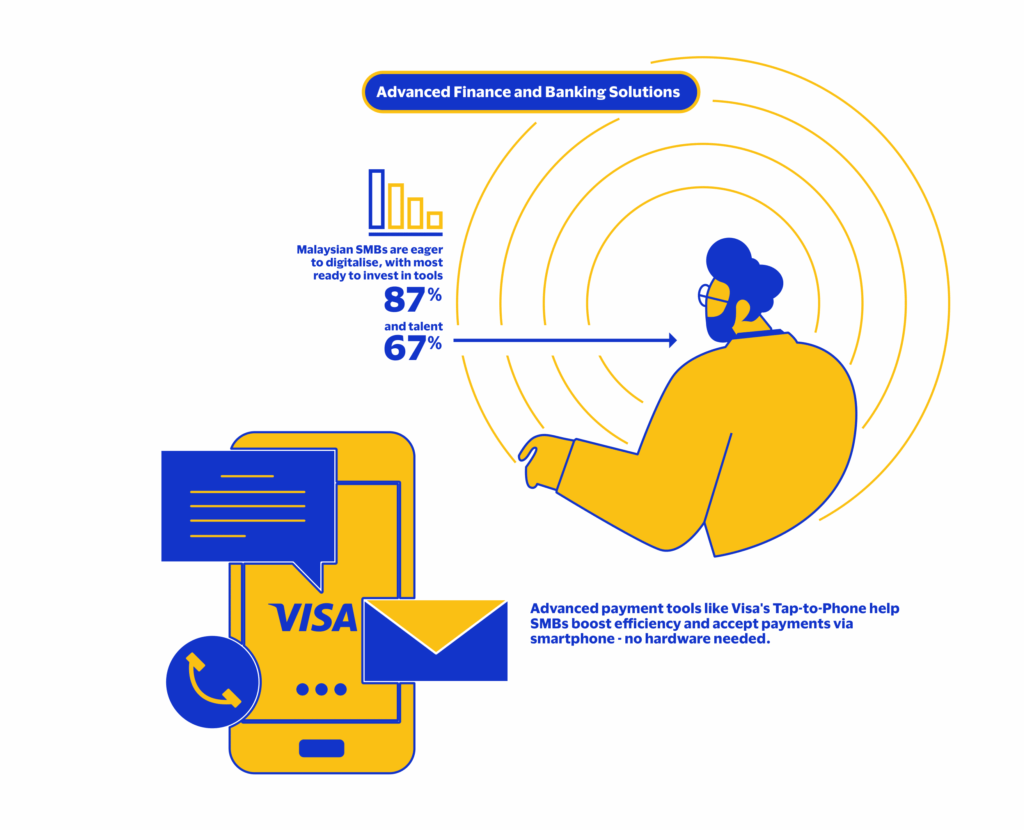

Digitalisation is also empowering Malaysia’s large population of street vendors and micro-SMEs—many of whom operate outside the formal banking system. To bridge this gap, financial service providers are offering inclusive, low-cost solutions.

Visa’s Tap to Phone is one such innovation. It enables micro-businesses to accept digital payments directly through smartphones—without the need for card readers or terminals. This solution dramatically lowers entry barriers, allowing even informal traders to offer fast, secure, and convenient cashless options. In turn, these businesses can diversify revenue, build trust, and formalise operations.

Why Business Cards Make a Difference

Efficient financial management is another priority for SMEs. Many still use personal cards for business expenses, creating confusion and increasing risks of errors during reconciliation.

Using business debit, prepaid, or credit cards offers clear advantages:

- Separation of personal and business expenses

- Real-time tracking and detailed transaction statements

- Integration with accounting software

- Access to higher credit limits and business-specific perks such as purchase protection and travel insurance

With these tools, SME owners can streamline bookkeeping and improve cash flow management, while also gaining access to rewards programmes and emergency credit lines for unplanned opportunities.

Laying the Groundwork for Future Growth

The shift toward digital tools and systems is no longer optional—it is essential for long-term survival and success. Digital transformation is enabling Malaysian SMEs to work smarter, serve customers better, and scale sustainably in a highly competitive environment. By embracing innovation and modern financial solutions, SMEs are not only adapting to current pressures—they’re laying the foundation for the next generation of business success stories in Malaysia.

1https://www.ey.com/en_my/insights/tax/how-private-and-sme-businesses-can-thrive-under-the-malaysia-madani-roadmaps

2https://www.idc.com/getdoc.jsp?containerId=US51281523

3https://www.fitchratings.com/research/banks/malaysia-new-digital-banks-unlikely-to-shake-up-sector-03-05-2022