Despite these challenges, resilient demand for electrical and electronics (E&E) products and a rebound in tourism are expected to provide critical buffers. In response to subdued inflation, Bank Negara Malaysia (BNM) is expected to implement monetary easing measures to support domestic demand.

Export Growth Buoyed by Temporary Surge

Malaysia’s goods exports jumped 26% year-on-year in April 2025, driven largely by businesses accelerating shipments to the US ahead of tariff hikes. However, this surge is likely to be short-lived, with export momentum expected to wane in the second half of the year.

In contrast, Q1 2025 goods export growth had already slowed sharply to just 1.6% year-on-year, compared to an average 7.1% over the prior three quarters, highlighting the fragility of export-led recovery (ICAEW 2025).

While Malaysia’s export base remains diversified, it continues to be exposed to global shocks. Over 4% of GDP and 11% of gross exports are tied to US demand, either directly or indirectly. The newly imposed blanket 10% US tariff—though lower than the proposed 24%—still presents significant downside risks for exporters.

Additionally, weaker demand from China, Malaysia’s top export destination, adds further pressure on the country’s external trade landscape.

Electronics and Tourism Provide Support

The electronics sector remains a bright spot. E&E exports have surged by approximately 20% year-to-date, buoyed by global demand for semiconductors and intermediate components essential to supply chains.

Meanwhile, the tourism sector continues its recovery. ASEAN visitors made up 67% of total tourist arrivals in 2024, and tourism-related services exports rose by 17% year-on-year in Q1 2025. However, future growth could be challenged by labour market uncertainties in key source markets.

Monetary Policy Takes the Lead as Fiscal Space Shrinks

With elevated public debt limiting fiscal flexibility, BNM is expected to play a central role in sustaining domestic momentum. Inflation remains subdued at 1.5%, paving the way for a 50 basis-point rate cut later in 2025. The central bank has already indicated a dovish stance aimed at stimulating private consumption and investment.

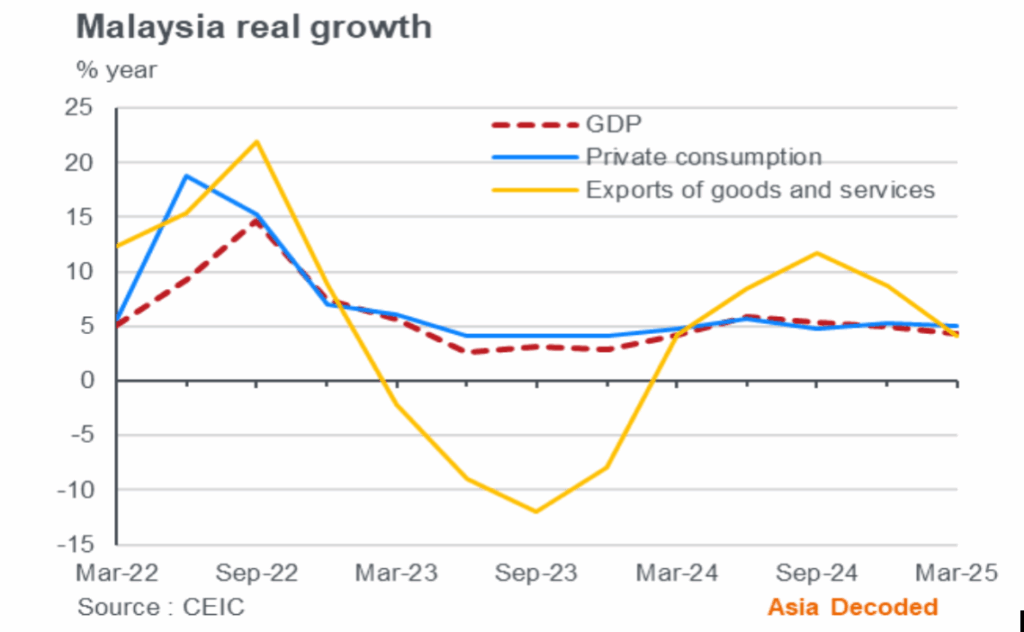

The ICAEW report also outlines a broad deceleration in key indicators—GDP, private consumption, and goods and services exports—from March 2022 to March 2025, reflecting both external challenges and cautious domestic sentiment.

Despite these headwinds, Malaysia’s economy is expected to remain on a steady, albeit slower, path, supported by robust sectors and timely policy interventions

Regional Outlook: Singapore and China

Singapore

- GDP contracted 0.6% QoQ in Q1 2025, as manufacturing and wholesale trade softened.

- A temporary 25% export boost in April from front-loaded US shipments may not prevent H2 weakening.

- Domestic impacts are emerging, with declines in hiring and employment growth.

- Strong fiscal buffers are expected to cushion the blow, with GDP growth forecast to slow to 1.8% in 2025, down from 4.4% in 2024 (ICAEW 2025).

China

- GDP growth expected to hover at 5% in Q2 2025, helped by a temporary US trade truce.

- External uncertainties and ongoing property sector fragilities are expected to dampen investment and private consumption.

- Deflationary pressures persist, and policy tools are unlikely to spark rapid recovery.

- Full-year GDP forecast stands at 4.4% in 2025, down from 5% in 2024 (ICAEW 2025).

GDP, private consumption and goods and services exports trends from March 2022 to March 2025

A Call for Regional Resilience

Dato’ Mohammad Faiz Azmi, Executive Chairman of the Securities Commission Malaysia and ICAEW Council Member, underscored the importance of ASEAN unity in facing global turbulence. Speaking at the ASEAN Investment Conference 2025 in Kuala Lumpur, he emphasised that deeper regional integration and intra-ASEAN investment would be key to long-term resilience.

“In a time of global uncertainty, working together and investing within the bloc will be key to unlocking the region’s potential,” he stated.