By Aileen Anthony

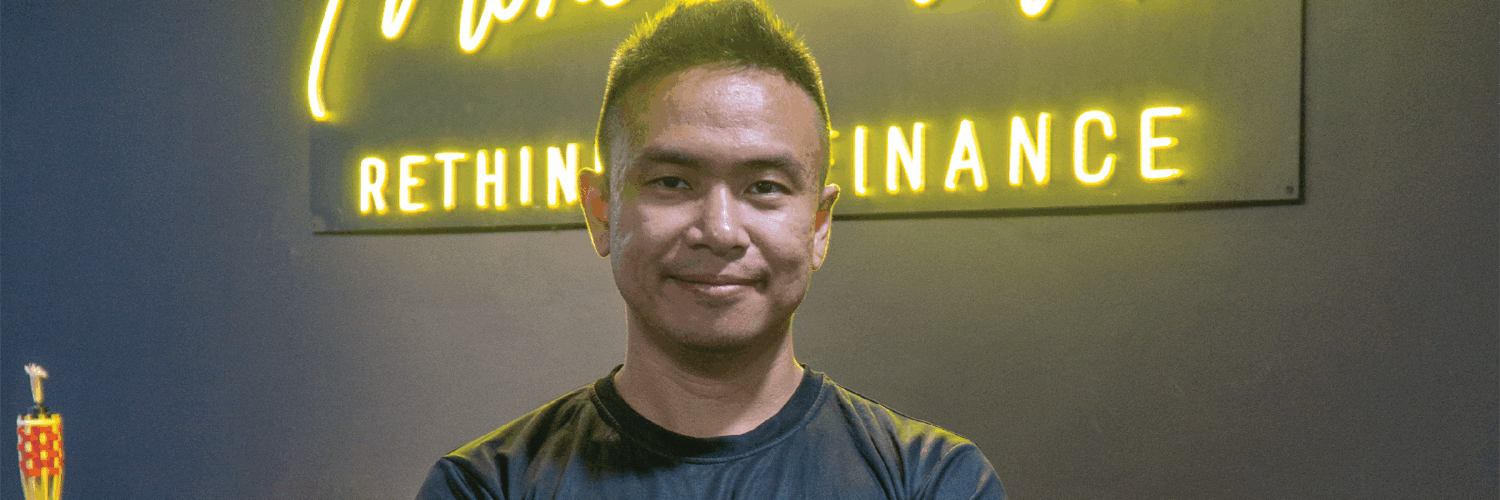

That shift—from flailing beginnings to profitable scale—captures the heart of MoneyMatch’s evolution. Founded by former bankers Adrian Yap and Naysan Munusamy, MoneyMatch started by challenging the inefficiencies of personal remittance services. Today, it’s grown into a cross-border payments powerhouse with a bold ambition: to level the playing field for SMEs navigating international transactions.

Rethinking the Bank Model

For decades, SMEs have relied on traditional banks for cross-border payments—more out of habit than true benefit. “A lot of businesses choose a bank based on proximity. It’s literally about which branch is closest to your office,” Haddy explained. “But the reality is, most commercial banks charge a premium unless you’re moving millions of dollars.”

That’s where MoneyMatch comes in. Through its proprietary platform Pulse, the company helps Malaysian SMEs send payments in over 40 currencies across more than 120 countries—often at rates significantly better than what banks offer.

“When you make a cross-border payment through a bank, you’re paying not just the exchange rate but also fees interlaced within the spread,” said Haddy. “Our platform sources the best rates from multiple banks, so instead of paying X ringgit to send a certain amount of USD, you’re paying X minus our savings. That’s often a 2-3% gain straight to your bottom line.”

It’s not just about price. Time is another asset. “We’ve built a global payment network that enables us to cut out unnecessary intermediaries. To certain countries like Indonesia, payouts are instant. With a bank, you’d wait two to three days.”

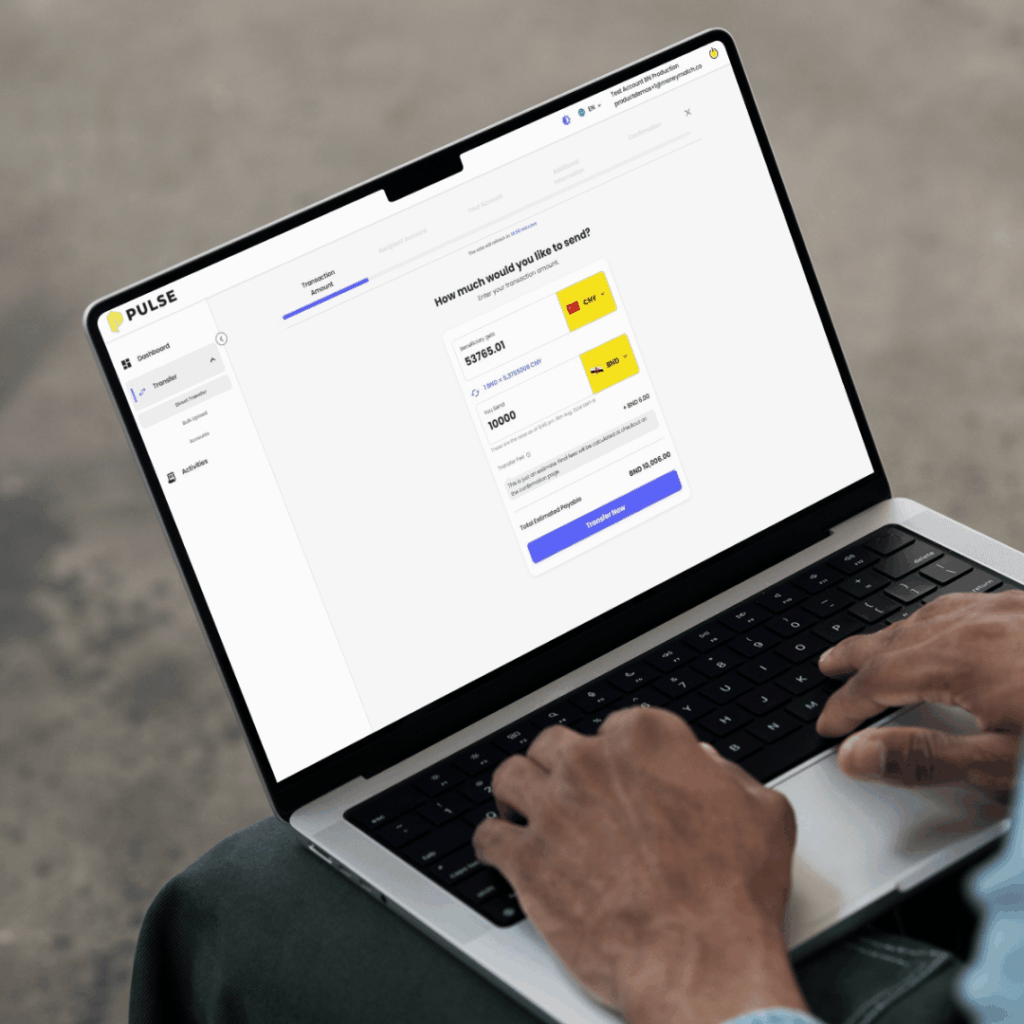

Pulse: An SME’s Gateway to Smarter Payments

Pulse is MoneyMatch’s business-facing platform that mirrors the familiarity of internet banking but delivers vastly better economics. Business users log in, choose the currency and amount, enter beneficiary details, and execute transactions. But the value goes deeper.

Every Pulse user is assigned a relationship manager (RM)—not a chatbot or a generic hotline. “We’re very high-touch,” Haddy emphasised. “Our RMs assist with onboarding, document verification, and deeper questions. For day-to-day queries, we’ve got dedicated support teams, including treasury ops for large-value transactions.”

This hybrid model—digital convenience with human support—strikes a chord with SMEs that still value the comfort of a trusted contact. “A lot of our customers are Chinese-speaking or based outside urban centers. We make sure we have multilingual RMs: Mandarin, Cantonese, Hokkien, Tamil, Bahasa—you name it. It’s about making people feel confident, especially when moving large sums across borders.”

Financing: Not the Core, But Still a Bridge

While MoneyMatch’s heart lies in FX and cross-border payments, Haddy acknowledged an emerging adjacent need: financing. “We don’t pretend to be experts in lending. That’s not our background,” he said. “But we do recognise that many of our SME clients need access to capital.”

Rather than reinvent the wheel, MoneyMatch integrates with major alternative financiers. “We have a financing tab on Pulse where customers can fill in basic needs. Based on that, we refer them to the right partner—someone who specialises in their industry, whether it’s GLCs, energy, or retail.”

It’s a value-add, not a pivot. “Financing isn’t our main push right now,” Haddy clarified. “But because we already have the transactional data, we can help validate these businesses—especially those with repeat cash flows that banks might overlook.”

From Malaysia to the Region

MoneyMatch is proudly Malaysian at its core, but its reach is undeniably regional. It holds licenses in six countries: Malaysia, Brunei, Singapore, Australia, New Zealand, and Hong Kong (pending bank activation).

Brunei, for instance, has been a particularly promising market. “We’re the first and only foreign payments company licensed in Brunei,” Haddy said. “They have quite a large import footprint, so the cross-border use case is huge. We were invited in by their central bank, and it’s been very encouraging.”

Singapore, meanwhile, presents a different dynamic. “It’s a highly competitive market, with global players. But we’ve found that we can compete toe-to-toe, especially with Malaysian businesses that have Singapore operations or do business across Australia, New Zealand, and Hong Kong.”

Not every market is a priority—yet. “Australia, for example, we’re not actively pushing. It’s expensive to build out, and we want to grow responsibly. Our strength is still in Malaysia and this region.”

Building Trust, One Relationship at a Time

Despite the tech-enabled efficiency of MoneyMatch’s service, the company knows that trust remains a human experience—especially in the SME world.

“Most business owners are cautious. They’ve never heard of us, so their first instinct is to ask: are you licensed? Is this safe? Is it too good to be true?” said Haddy. “That’s why we don’t rely on flashy ads or billboards. We send people to the ground—our own team—to meet decision-makers, onboard them properly, and earn their trust.”

The company also actively participates in industry associations and attends local trade conferences and chambers of commerce events to build credibility in person.

This people-first strategy has paid off. “Since COVID, adoption has really improved. The pandemic made businesses more open to digital platforms and more aware of cost savings. But we’re still early in the curve. A lot more SMEs could benefit—they just haven’t heard about us yet.”

The People Behind the Platform

While the MoneyMatch platform has matured, so has its team. The company operates with a lean but capable workforce, skewed toward young talent. “We tend to hire fresh grads or those with less than five years of experience,” Haddy shared. “They learn a lot here, very fast. But yes, many move on. It’s part of the cycle.”

Senior management, meanwhile, carries the institutional knowledge. “We’re the ones cascading down experience. But it’s not a bad thing. We see ourselves as an early chapter in many people’s careers—and we’re proud of that.”

Talent retention is a challenge, but culture is the glue. “If you stay here for even a year, you’ll learn so much that you could teach someone else,” he added.

The company is also open to grooming future professionals through ties with professional bodies. “I’m an ICAEW member myself,” Haddy said. “We’ve had team members pursuing ICAEW and similar qualifications. I’m happy to support that kind of professional development.”

What’s Next?

Now profitable, MoneyMatch is no longer chasing survival—it’s building scale. That brings a new set of challenges, particularly around regional growth and customer education. But the company is up for it.

“We’re not trying to be everything to everyone. But when it comes to international payments, we want to be the go-to name for Malaysian SMEs,” Haddy shared. “It’s about saving them money, giving businesses a faster alternative, and providing real support—whether they’re paying a factory in China or doing payroll for a team in Vietnam.”

For the SMEs out there who still think their only option is the bank down the road, MoneyMatch has one message: there’s another way. And it’s already here.